Untron Core in one breath

Now, let's clean up some accumulated confusion about what Untron Core does and how it works.

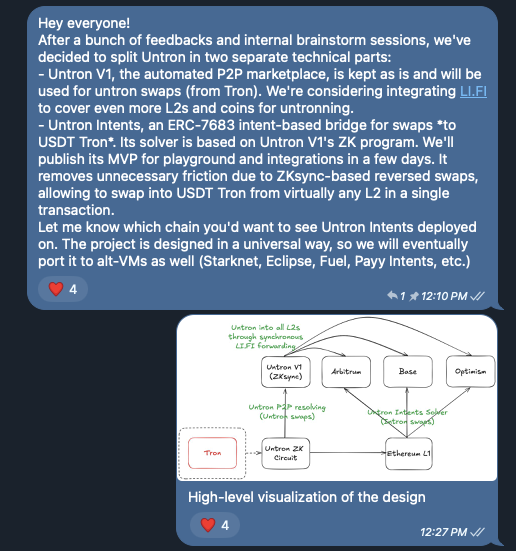

Untron Core is a smart contract that manages peer-to-peer (P2P) orders between USDT on Tron and its native chain—in our case, ZKsync Era. The orders are P2P because technically people buy and sell USDT for USDT from each other, just on the different chains. To verify the fact of USDT transfer on Tron network, Untron Core utilizes ZK proofs of Untron Program.

Order Workflow in Untron Core

Warning: This diagram is slightly simplified and must not be used for reimplementation or logic auditing.

Untron Core natively supports swaps between USDT (used as liquidity) and other tokens through 1inch Aggregator, and cross-chain transfers of these tokens through Across Bridge. This way, as long as there's a way to initiate an untron swap on ZKsync Era, users can untron into any token on virtually any chain of the Ethereum ecosystem.

/// @notice The order creation function

/// @param provider The address of the liquidity provider owning the Tron receiver address.

/// @param receiver The address of the Tron receiver address

/// that's used to perform a USDT transfer on Tron.

/// @param size The maximum size of the order in USDT L2.

/// @param rate The "USDT L2 per 1 USDT Tron" rate of the order.

/// @param transfer The transfer details.

/// They'll be used in the fulfill or closeOrders functions to send respective

/// USDT L2 to the order creator or convert them into whatever the order creator wants to receive

/// for their USDT Tron.

function createOrder(address provider, address receiver, uint256 size, uint256 rate, Transfer calldata transfer)

external;(from IUntronCore.sol)

/// @notice Struct representing a transfer.

struct Transfer {

// recipient of the transfer

address recipient;

// destination chain ID of the transfer.

// if not equal to the contract's chain ID, Across bridge will be used.

uint256 chainId;

// Across bridge fee. 0 in case of direct transfer.

uint256 acrossFee;

// whether to swap USDT to another token before sending to the recipient.

bool doSwap;

// address of the token to swap USDT to.

address outToken;

// minimum amount of output tokens to receive per 1 USDT L2.

uint256 minOutputPerUSDT;

// whether the minimum amount of output tokens is fixed.

// if true, the order creator will receive exactly minOutputPerUSDT * amount of output tokens.

// if false, the order creator will receive at least minOutputPerUSDT * amount of output tokens.

bool fixedOutput;

// data for the swap. Not used if doSwap is false.

bytes swapData;

}(from IUntronTransfers.sol)

To prevent order spamming, Untron Core implements a collateral system, where each order creator is required to send a certain amount of collateral to the contract. This collateral is slashed and sent to the Core controller if the funds for the order were not sent to the receiver and the order wasn't stopped by the creator before expiration (5 minutes).

Untron team aims for the collateral size to be roughly equal to the opportunity cost of creating the order. That is, it's expected to be close to what all parties in the protocol would earn if the created order was properly executed.

function requiredCollateral() external view returns (uint256);(from IUntronCore.sol)

Untron is B2B or why collateral is a good UX

It's important to keep in mind that Untron is a B2B protocol. In other words, Untron Core is not intended for end-users to interact with. Instead, various projects integrating Untron will provide necessary infrastructure for their users to interact with the protocol. For example, the project provides collateral itself and might decide to automatically stop all its unexecuted orders after 3 minutes, rather than 5, to keep their collateral.

The best, albeit not the most obvious, example of such integration is Untron.finance (opens in a new tab)—the official frontend for Untron, built by Untron team. Untron.finance provides a straightforward interface to swap between USDT Tron from any wallet and chain without any collateral. Instead, it uses advanced internal logic to rate-limit dishonest users and prevent them from spamming orders. Therefore, from the technical point of view, Untron.finance is just one of the projects that utilizes Untron for its operations. If Untron.finance goes down, users can come to an alternative frontend, when such will be made, or use projects that integrate Untron directly—Clave (opens in a new tab), Daimo (opens in a new tab), Peanut (opens in a new tab), and more—to perform swaps through them.

Intron Swaps

TODO: In the first iteration of Untron, Untron V1 was used to perform swaps in both sides. We implemented Untron Intents, a second, multi-chain protocol in the Untron ecosystem, that significantly improved UX for intron swaps. However, its documentation is still in progress. If you want to learn more about them now, please reach out to us.